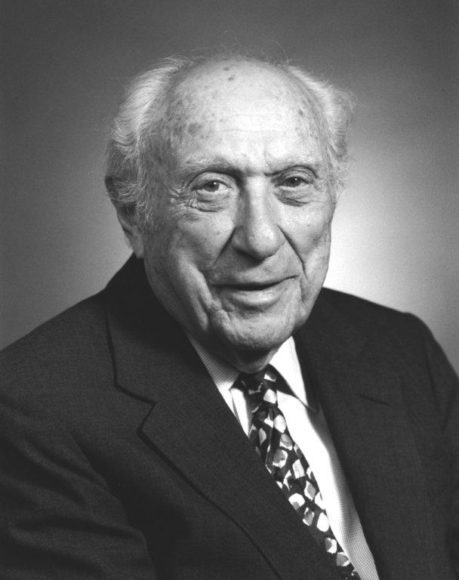

When William J. Peterson was a baby – the child of a young mother abandoned and left homeless – a New York-based social services agency facilitated his adoption, delivering him into a fulfilling life.

Today, that organization is his largest client.

It’s a testament to life coming full circle, says colleague Laurie A. Davis. But it’s also a metaphor for the way the personal and the professional blend at Manhattan-based Neuberger Berman, a private, independent investment management company owned by its employees. There are no outside influences on investment choices. At Neuberger Berman, “100% of employee-deferred cash compensation is directly linked to team and firm strategies,” as per its website. Or as Peterson, a managing director and senior wealth adviser, puts it: “We eat our own cooking.”

Neuberger Berman’s recipe for success? Start with classic financial ingredients, including 669 investment professionals — out of more than 2,500 employees — in 37 cities across 25 countries who have decades of experience in asset management, most of it at the firm. (Its retention level for senior investment professionals is 96%, says Davis, a senior vice president and wealth adviser.) Then add diversified portfolios tailored to each client’s needs. Some clients have short-term goals, which Neuberger Berman can accommodate. But the quintessential NB clients — individuals, corporations and foundations — play the long game with a blend of equity, fixed income, private equity and hedge fund instruments that nonetheless allow for cash flow. “You have to be able to eat well and sleep well,” Peterson adds.

The result is a firm — one whose past and present have strong ties to Westchester and Fairfield counties — with 90%-plus client retention rate and $447 billion in assets.

The art of investment,

an investment in art

It’s also a firm that the newspaper Pensions&Investments has cited as “one of the best places to work in money management.” Peterson and Davis credit the collegial atmosphere. “We’re all coworkers here,” Davis says.

They’re surrounded by some 500 works of contemporary art in various media that the firm began collecting in 1990, offering tours to clients. (When Lehman Brothers acquired Neuberger Berman in 2003, it also acquired the artwork. Five years later, Lehman Brothers would fold amid the Great Recession. In July 2010 and May 2011, the newly independent Neuberger Berman repurchased a good deal of this work from the Lehman Brothers estate.)

But then, Neuberger Berman has always been about investing in art as well as the art of investing. The firm was founded in 1939 principally by Roy R. Neuberger, perhaps just as well-known to our readers as the founding patron of the Neuberger Museum of Art.

Witty and aesthetic — Peterson quotes him as describing the stock market as “the only market people run from when there’s a sale” — the Bridgeport-born Neuberger was as passionate about art as he was about playing tennis. Indeed, during several interviews in the course of his 107 years on this earth (1903-2010), he told us that the reason he got into the financial game was to support artists, so outraged was he after reading in Floret Fels’ “Vincent van Gogh” (Paris, 1928) that the painter sold only one work, “The Red Vineyard” (1890), in his lifetime.

“Roy’s first (financial) job was in a bucket shop,” Peterson says, so-called because young assistants like Neuberger would take chalk from a bucket to record the gains and losses of Dow 30. In one of the great Wall Street stories, Neuberger shorted 300 shares of the most popular stock of the day, RCA (Radio Corporation of America), betting it would tank from its lofty height of $500 a share. When the market crashed in 1929, ushering in the Great Depression, Neuberger lost only 15% of his money as others lost everything.

He would go on to collect a Who’s Who of modern art, including Edward Hopper, Georgia O’Keeffe, Jackson Pollock, Willem de Kooning and especially Milton Avery, whose Matisse-like, color-block style made him Neuberger’s favorite artist.

And though he liked to joke that his good friend and fellow collector Nelson A. Rockefeller — former New York state governor and vice president of the United States under Gerald R. Ford — twisted his arm to donate 300 works from his collection to establish the Neuberger Museum of Art in 1969 as part of the conservatory-style State University of New York, College at Purchase (now Purchase College), he always said he hoped to inspire a new generation of art patrons.

Investing in communities

That philanthropic legacy is also part of Neuberger Berman. We first met Peterson and Davis at the recent fundraising luncheon for Fairfield County’s Community Foundation, The Fund for Women & Girls, where the firm sponsors a table annually. As part of its Environmental Social and Governance (ESG) investing, Neuberger Berman is a signatory to the Net Zero Asset Managers Initiative, whose goal is to achieve net-zero emissions in accord with the Paris Agreement.

In addition, the firm operates a program of volunteerism, mentorship and partnership through the Neuberger Berman Foundation, says Maria Angelov, who leads the company’s Corporate Social Responsibility (CSR) efforts and serves as president of the foundation (annual budget of $1.75 million).

Among the organizations that Neuberger Berman has worked with, Davis says, are Blythedale Children’s Hospital in Valhalla, the Boys & Girls Club of Northern Westchester in Mount Kisco, The Guidance Center of Westchester in Mount Vernon, the Neuberger Museum of Art, Volunteer New York! In Tarrytown and the Westchester Land Trust in Bedford Hills. Neuberger Berman has also done beautification projects in Connecticut with the YMCA of Stamford and Save the Sound in New Haven.

“Ninety percent of grant recipients are recommended by employees,” who do everything from sitting on boards to providing boots on the ground, Angelov says. Peterson, who studied economics and psychology at Fairfield University before finding his way to Neuberger Berman in 1992, hasn’t forgotten his humble roots. He mentors at-risk youths and heads a nonprofit instructional sailing program. A graduate of the University of Delaware and a Fordham University M.B.A., Davis is a board member of LIFT-New York, helping people achieve economic stability.

Says Angelov: “We care about the communities we live and work in.”

For more, visit nb.com.