Stocks, bonds, real estate: Mention the word “investment,” and these are the categories that immediately come to mind. Other possibilities are considered, too, as people look to diversify, to build and safeguard wealth. These days, with headlines about record prices for all forms of artwork, from Old Master paintings to an NFT — or nonfungible token, the digital world’s answer to a provenance on paper — of a Banksy creation (it proved to be a $366,000 hoax), the idea of art as an investment keeps coming up.

In the serious world of serious money, an investment is an expenditure on something that (you hope) will be worth more than its purchase price at a future date. An expenditure that is expected to result in a profit in the short term (again, you hope) isn’t an investment. It’s a speculation.

The plain truth is that the art market is driven by trends. And trends can and do change — quickly, dramatically and unpredictably. Often, by the time “everybody” is talking about an artist (or a style of clothing, or a restaurant — you get the idea) the market has peaked and demand has started to drop.

Most knowledgeable art buyers are collectors who buy works that are meaningful to them. They intend to enjoy their art for a long time and don’t approach their purchases with profit in mind. Their watchwords are “Buy what you love, love what you buy.” An increase in value is always welcome, of course, but it’s not a primary motivation.

The single most important and most repeated advice to collectors in any category is to buy the best you can afford. “The best” keeps its value, gives pride of ownership and, if the time comes to sell, it always finds a market.

That doesn’t mean that art collecting is just for those who can afford a major work by Rembrandt, Picasso or Jeff Koonz. A multimillion-dollar budget isn’t the only way to acquire great art, in great condition, by great artists. You can purchase fine art prints, photographs and other limited-edition pieces by important artists for as little as a few hundred dollars.

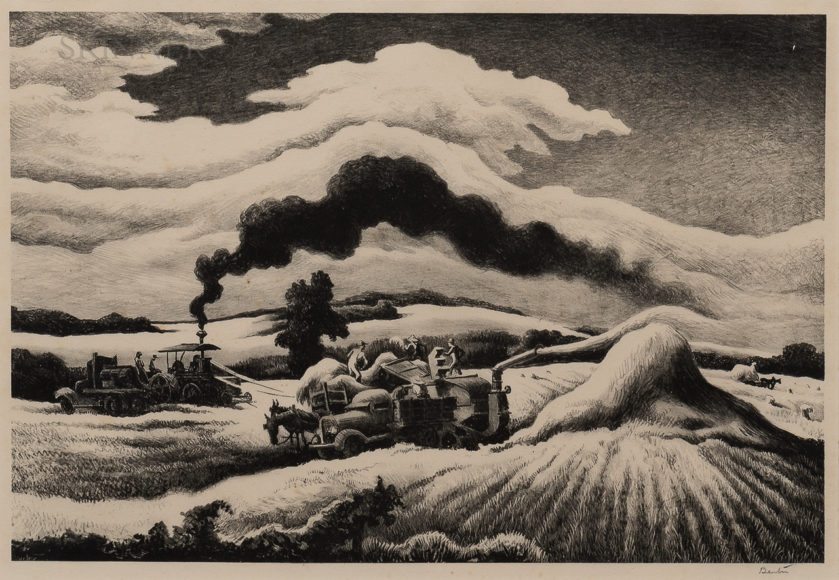

Robin Starr, Skinner’s vice president and director of American & European Works of Art, gives us as an example a comparison between American Realist Thomas Hart Benton’s painting “Threshing” with his 1941 lithograph of the same title. “The lithograph will cost you a mortgage payment or two. The painting will cost you the price of the whole house. So why not have your house and decorate it, too?”

When collecting art, it makes sense that pleasure of ownership should come before considerations of profit. But it’s also sensible to expect value for money. The condition and, of course, the authenticity of any artwork are of prime importance, and determining these matters is where experience counts. Sometimes condition issues can be hard to identify. It may come as a surprise to find out that a signature isn’t always a guarantee of authenticity.

The best values in works of art can be found most reliably at sales held by auction houses that have specialist art departments. They offer the expertise that assures buyers and sellers alike of reliable research and deep knowledge of a rapidly changing marketplace.

Buying trendy artwork with the intention of quickly selling it for a big profit is like trying to time the stock market — an exercise in futility. Today’s “hot” is often tomorrow’s “not.” Tastes and trends change, taking prices with them. Lasting value is the pleasure that comes from living with the things you love.